End of Support for Microsoft Products: What You Need to Know

Stay informed about the end of support for Microsoft Office 2016 & 2019, Exchange Server 2016 & 2019, and Windows 10.

In this article readers will learn:

You never value it until it’s gone.

Imagine you’re an owner of a big company that has hundreds of locations all over your country. You’re a market leader in your industry and the most popular one. Customers love you. They return to you often because of the warm atmosphere you create in your branches. This happy story could go on. But, no.

One day you suddenly realize there are lots of thefts happening regularly in the different locations of your business, at different times of the day, and with different people. The frauds aren’t big, however, it’s hundreds of them happening every day.

You would like to focus on growth and R&D and not a fire-fight with disturbances, but the sheer number of these frauds makes the total number of business losses widen and grow. Though you had planned to invest time and money into new projects and initiatives, you can’t now because you have to figure out what to do with these pesky little frauds that are adding up and starting to bite your bottom line.

Every day enormous amounts of data are created. In 2020, people created 2.5 million terabytes per day. By 2025, this figure is expected to grow to 463 exabytes, which is 463 million terabytes every day. Thanks to the COVID-19 pandemic, which has accelerated the digitization of businesses across different industries, we can anticipate that the numbers for data will grow manifold and higher than estimated. As a result, businesses have to adapt and modernize swiftly in order to keep up with market competition.

Nevertheless, the speed of digital transformation comes with its risks and the entire endeavor can cause more harm than good. As the company servers are loaded with tons of data, handling it properly can pose a huge challenge for a business. Fraudulent activities have the potential to collapse the entire system and this can only be prevented when there’s a system to detect anomalies and outlier activities. Therefore, it is essential that fraud detection policies are considered in the design stage of the system, so they won’t weaken the overall risk profile of a business.

Fraudulent activities have the potential to collapse the entire system and this can only be prevented when there’s a system to detect anomalies and outlier activities.

The good news is that rigorous anomaly detection mechanisms can be built to safeguard organizations against fraud-related losses and damages. As there are hundreds of ways to do fraud, it’s quite difficult to gather the information about all of the potential anomalies in a dataset beforehand. Yet, since the majority of user actions are “normal”, this information can be captured and the outliers in the data can be identified.

The most important task of the anomaly detection system is to capture fraudulent activities proactively, so that they can be promptly acted upon and won’t cause damages and losses for the company.

In the next section of this article we will take a deeper look into the types of anomaly detection algorithms and understand in which cases each of these algorithms can be applied.

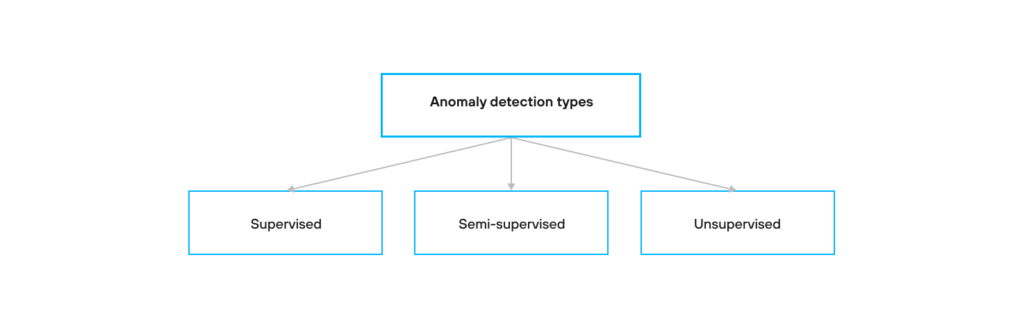

There are three types of anomaly detection algorithms: supervised, semi-supervised, and unsupervised. All these algorithms are machine learning techniques that are especially effective when they are needed to detect fraud within a huge volume of data, which is most likely humanly impossible.

Supervised anomaly detection techniques involve training a classifier on a labeled dataset, where the data is labeled as “abnormal” and “normal”. When a new data point appears, it needs to first be classified.

The main benefit of a supervised anomaly detection model is that it produces highly accurate results.

Still, supervised anomaly detection warrants acquiring large amounts of normal and abnormal examples. Capturing such a dataset is complicated and laborious, as the anomalous data points are scarce. In addition, as there are many distinct types of anomalies in any domain, the new anomalies can differ substantially from the ones detected before. Therefore, it may be hard for supervised anomaly detection algorithms to learn from the anomalous data points and how they look.

In contrast to supervised anomaly detection, in unsupervised anomaly detection there are no labels or classifications of data to train upon. Basically, unsupervised anomaly detection classifies a data point as an anomaly if it substantially deviates from the rest of the data. This methodology is used in cases where the real anomalies are few and differ significantly from the normal instances. However, this is not always the case, and the algorithm can identify some instances as anomalies, but in fact they are not anomalies.

The benefit of unsupervised anomaly detection techniques is that there’s no need for data scientists to label data in a dataset.

The disadvantage of unsupervised anomaly detection is that the algorithm doesn’t improve its performance over time.

Since labeling data is usually a time-consuming and expensive procedure, in many cases, there are a lot of unlabeled instances, and few labeled instances. Some algorithms can deal with partially labeled training data. They are referred to as semi-supervised learning algorithms. Most semi-supervised anomaly detection algorithms are a combination of supervised and unsupervised detection algorithms. They are trained in an unsupervised manner, but then the system is tuned using supervised learning techniques.

So, semi-supervised learning overcomes one of the supervised learning problems when there is not enough labeled data. However, when applying semi-supervised learning, there are certain assumptions related to smoothness, clustering, and manifold, so one must ensure they are not violated.

Each of the anomaly detection algorithms has its own applications. Supervised algorithms are great when the anomalous and non-anomalous data points are labeled as they have high prediction performance. When there are no labels in the data, only unsupervised anomaly detection algorithms can be used. Still, semi-supervised anomaly detection algorithms are better than supervised ones in a number of cases when:

In the case studies presented at the end of this article, we’ve used semi-supervised and unsupervised anomaly detection algorithms.

→ Read about automated anomaly detection and what tools and techniques we at Avenga use for it.

In the next section you will read about the phases of the anomaly detection process.

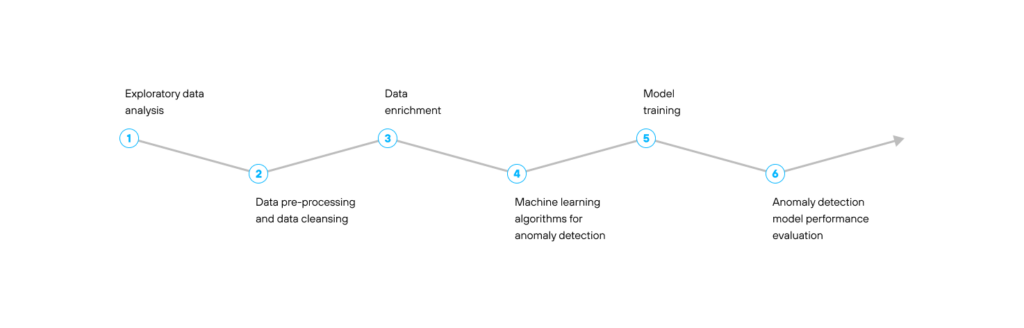

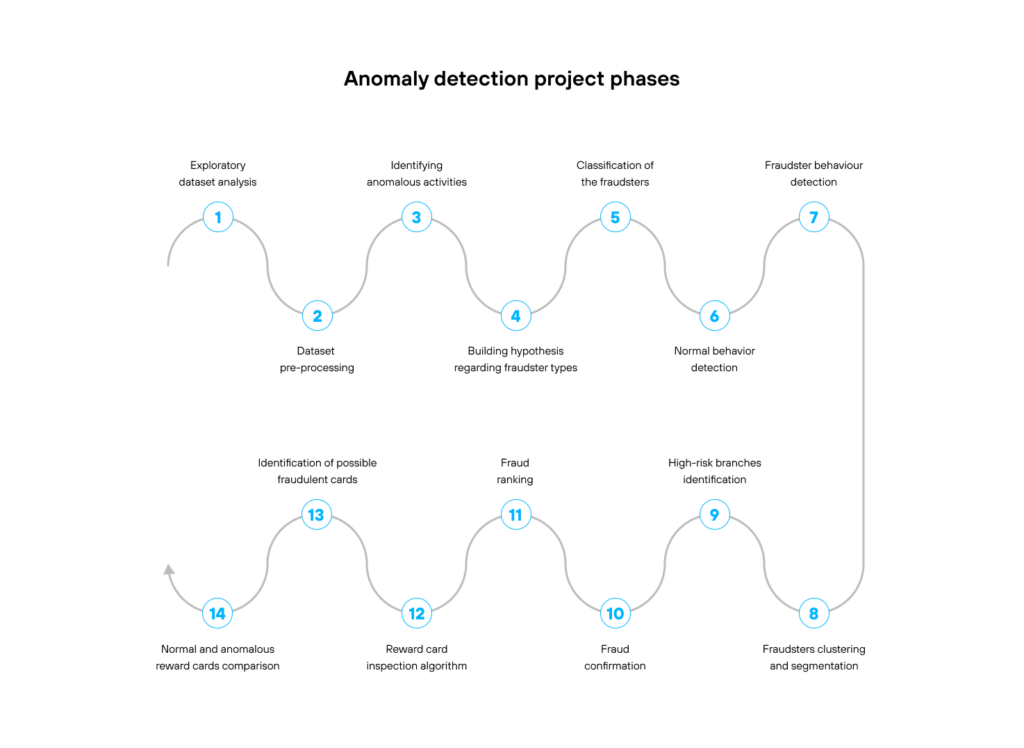

The anomaly detection process consists of the following phases:

In the subsequent paragraphs we will describe the stages of every phase and the techniques that are most often used for anomaly detection.

Exploratory data analysis is an initial phase during the anomaly detection process as it helps to perform initial research in the data to discover patterns and outliers in the data. It defines how to best manipulate data sources to get information about the anomalies and the relationships between them. During the data exploration stage, a data scientist visually explores the data and identifies possible outliers in the data. These outliers can potentially signal fraud. The frauds have their distinctive features, such as a number of transactions, behavioral time patterns, accumulation of reward patterns, etc.

While performing exploratory data analysis, data scientists can test their hypotheses and assumptions and then determine the most appropriate anomaly detection techniques. To find out more about how we do exploratory data analysis at Avenga, please contact us.

In the case of supervised anomaly detection approaches, data pre-processing and data cleansing are one of the most important phases that provide the machine learning algorithm with the proper dataset to learn on. The impossible data combinations, out-of-range values, and missing data can generate misleading results.

Proper data pre-processing ensures that the data quality is high, which in turn ensures the results are accurate.

The anomalous examples identified during the data cleansing stage are important samples for learning.

Data enrichment involves enhancing and appending the dataset with relevant additional information. It includes supplementing missing or incomplete data, as well as preparing and structuring the data for machine learning algorithms. Data enrichment helps to process the multi-structured data more efficiently, and improves the accuracy and the quality of the anomaly detection results.

Data enrichment also includes collecting data from third-party vendors or web scraping, thus adding publicly available datasets. An example would be the LexusNexus credit card scores, identity checking, and information from social profiles.

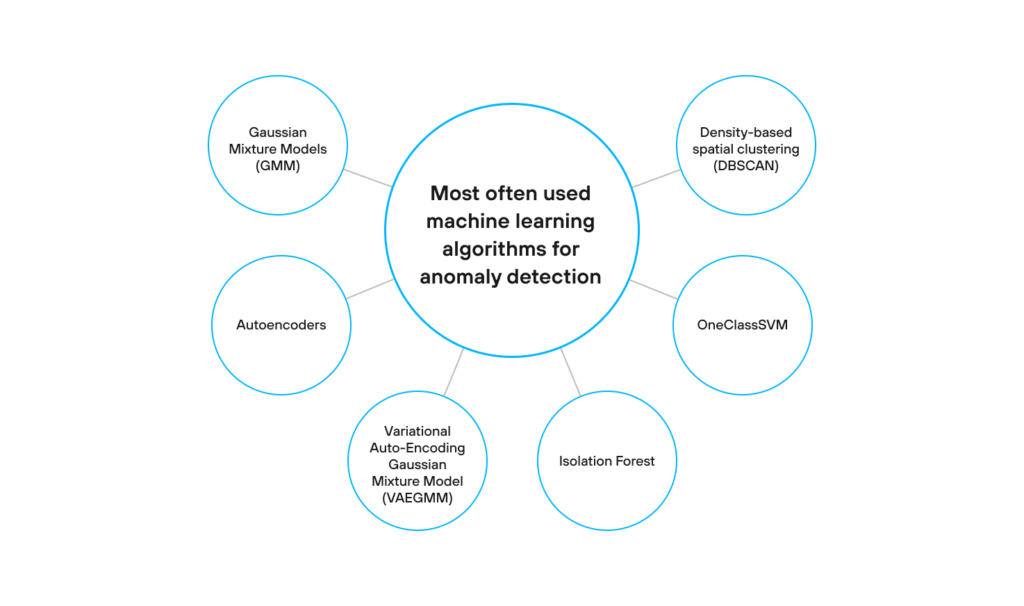

Once having a better understanding of what patterns to look for, a data scientist identifies the most appropriate machine learning algorithms that can aid with anomaly detection. It should be pointed out that anomalies in high-dimensional datasets may follow quite complicated patterns and might be difficult to detect. That is why machine learning algorithms are highly effective in determining anomalies in big data sets. In particular, the Autoencoders, Variational Autoencoders, GMMVAE, Isolation Forest, OneClassSVM, and DBSCAN are the most often used machine learning techniques to detect anomalies. In the subsequent paragraphs we’ll dive deeper into these algorithms and explain how they work.

Gaussian Mixture Models (GMM) are used to build clusters. GMM is an unsupervised machine learning algorithm that is utilized to cluster unlabeled data. In particular, GMM performs a soft classification of data points, thus providing the information on which data point belongs to what cluster in addition to the probability at which the given data point may belong to each of the possible clusters.

Autoencoder is a neural network with the same input and output variables. The main task of autoencoders is representation learning: setting an encoder and decoder as neural networks, and learning the optimal encoding-decoding scheme using an iterative optimization process. After every iteration, the autoencoder is fed with the data. Then, the produced input is compared with the initial data and the neural network is used to calculate the error (loss) function according to the neural network’s weight.

The purpose of using an autoencoder network is to capture the correlation between the different variables. First, the autoencoder algorithm is trained on a dataset that represents “normal” data points. Next, it compresses and reconstructs the input variables. The following phase is dimensionality reduction, during which the autoencoder network learns the interactions between the various variables and data points, and reconstructs them back to the original variables at the output stage.

As this process takes place, one can start to see the growing error in the autoencoder network reconstruction of the input data points. By monitoring this error, a data scientist can get an indication of the anomalies in the dataset.

The Variational Auto-Encoding Gaussian Mixture Model (VAEGMM) anomaly detection model uses a variational autoencoder (VAE) to provide the probability distribution for each attribute. First of all, let’s dive deeper into what a variational autoencoder does.

Variational autoencoders are built in such a way so as to produce a statistical distribution (a range of possible values) that enforces a continuous and accurate data representation. Instead of building a usual encoder that outputs a single value to represent every data point, variational autoencoders represent a probability distribution for every data point. This methodology is the best one for detecting anomalies.

The VAEGMM model utilizes the benefits of both the Gaussian Mixture Model and variational autoencoders. It is used to improve the unsupervised clustering performance.

So to simplify it: first, the autoencoder generates a latent representation of the data; then, this representation is fed into GMM to perform a density estimation.

The VAEGMM algorithm significantly outperforms conventional anomaly detection techniques.

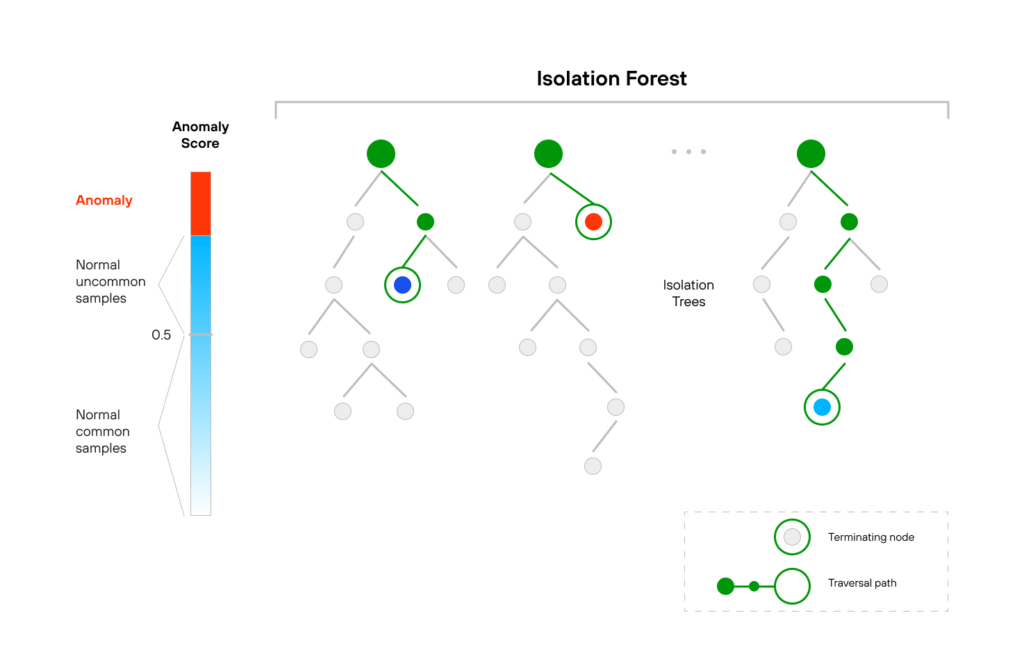

Isolation Forest is an unsupervised and nonparametric algorithm based on trees. Isolation Forest is very similar to Random Forests and is built based on an ensemble of decision trees for a given dataset.

In particular, this algorithm is very effective in carrying out anomaly detection in high-dimensional datasets. It helps to identify anomalies using the isolation methodology, where abnormal data points are isolated from the dataset. The Isolation Forest algorithm is especially useful as it does not require conducting the time-consuming process of normal data point profiling or building a model or cluster.

Isolation Forest perfectly deals with the datasets that have a considerable number of irrelevant attributes, as well as in situations where a training set doesn’t have any anomalies.

OneClassSVM is one more unsupervised machine learning algorithm for anomaly detection. It classifies new data as identical or distinct from the training dataset. OneClass SVM is an extension of the SVM (Support Vector Machine) learning algorithm that allows training a classifier when anomalous data is absent. The algorithm trains itself to treat a certain number of normal data points as if they belong to anomalies. This enables the setting of a boundary between the normal and anomalous data points.

While the standard SVM separates the two classes using a hyperplane with the largest possible margin, one-Class SVM uses a hypersphere to encompass all of the instances. The “margin” refers to the outside of the hypersphere; so, by “the largest possible margin“, we mean “the smallest possible hypersphere“.

Clustering analysis is used to group the data into clusters. It is one of the most popular techniques in unsupervised machine learning. However, clustering analysis is not an automatic task, but rather an iterative process of knowledge discovery that involves trial and failure. We used a density clustering model called ‘density-based spatial clustering of applications with noise’ (DBSCAN). This algorithm is used to group together data points that are close together (data with many nearby neighbors) by ranking as outliers the data points that lie alone and whose nearest neighbors are far away. The DBSCAN algorithm perfectly suited our client’s case, as the task was to identify fraudulent activities by company employees who used their loyalty cards to accumulate rewards instead of customers; see the case study near the end of this article. It’s one of the most common clustering algorithms and it is especially efficient for spectral clustering and finding connected data points on the asymmetric reachability graph.

Once the anomaly detection algorithms have been chosen, the anomaly detection model helps to obtain predictions about the new anomalies. To make it work, the anomaly detection model first needs to be trained. In the supervised anomaly detection approach, the model is trained by correct answers that are called target attributes. The anomaly detection algorithm finds patterns that represent input data in order to target attributes and then outputs an algorithm that depicts these patterns. In the unsupervised anomaly detection setup, there are no target variables.

In the case study that will be described further in this article, our task was to identify the fraudulent cards and the fraudster’s locations. We’ve started with the analysis of the data itself (without labels) and then added some information about fraudsters’ locations in the learned clusters to fine-tune the algorithm. Using supervised anomaly detection techniques was quite a time-consuming endeavor, as every fraud needs to be validated through video recordings. Therefore, Avenga’s data science team used unsupervised and semi-supervised anomaly detection algorithms, as they were the most suitable for the client’s use case.

After the anomaly detection model has been trained, the results it produces have to be evaluated so as to determine the accuracy of the model’s performance for the future on yet unseen data. There are two approaches to evaluate an anomaly detection model’s performance:

The holdout approach is often used to assess the anomaly detection model’s performance because of its speed, flexibility, and simplicity. The goal of the holdout evaluation technique is to examine the model with the different data that it was trained on. This technique produces a fair estimate of the quality of the model. To follow the holdout approach, the dataset is divided into three subsets:

The cross-validation evaluation technique is used to assess the model’s performance on an independent data sample. This technique is often used to evaluate the machine learning model’s performance on unseen data and estimate how well it can make predictions on new data.

It’s always better to have a bigger dataset for the training anomaly detection model. When we reduce the volume of a dataset, there’s a risk of missing valuable patterns. K-fold cross-validation is the prevailing method, because it’s simple to understand and it produces a less biased evaluation on how well the model performs, especially if compared with other methods, such as the usual train & test split.

The standard process of the K-fold cross validation is the following:

In the next sections we will introduce two anomaly detection use cases that the Avenga teams have worked with.

The Avenga Data Science team developed a comprehensive anomaly detection system for the world’s leading on-demand insurance platform, Trōv. The solution detects fraudsters (suspicious clients) before insurance claims are paid and helps the company to prevent fraud-related losses and damages.

During the first step, the team used unsupervised machine learning techniques to detect suspicious groups of users before the labeled data was gathered.

At the next step, the team proceeded to feature engineering (feature is a signal of a fraud). The features include the submitted insurance claim frequency, denied and cancelled claims, claim size, etc.

After that, supervised machine learning techniques, along with neural networks, were used to learn suspicious patterns from samples and detect them in new cases based upon the labeled dataset.

The anomaly detection solution Avenga’s team developed works in the following way:

1. The customer submits a claim.

2. The machine learning model generates features (signals) that may indicate fraud. Such signals include, but are not limited to the following features:

3. The anomaly detection model predicts scores for each signal (feature) and gives each claim a risk score on a scale of 0 – 1.

4. The anomaly detection model sets thresholds for what proportion of claims should be accepted/denied/manually reviewed.

The benefits of this solution were the following::

→ Read more about the Trōv success case.

The Avenga team developed an anomaly detection model for a client that has several hundred branches all over their country. The company implemented loyalty program cards that enabled company customers to accumulate points when buying goods from a set of shops.

The company faced some loyalty program fraud cases that limited the client in establishing a lasting and profitable bond with customers and threatened customer retention.

The project’s goal was to review how people use the loyalty cards in order to find fraudster behavior patterns earlier, as well as the types of fraudsters based on the possible fraud features (number of transactions, behavioral time patterns, accumulation of points patterns, etc.).

The anomaly detection project consisted of the following phases:

The Avenga Data Science team analyzed the company’s dataset which contained the data of several hundred thousands of users and came up with six possible types of fraud. They were based on the number of transactions, behavior time patterns, spending and accumulation of points behavior, etc.

Using anomaly detection algorithms, the company’s users were segmented into fraudster and non-fraudster classes. Key features and a description were built for the fraudster behaviors. Classifying the atypical user’s behaviors helped to quickly identify fraudsters into one of the six fraud types.

The team discovered valuable insights into the different frauds using the loyalty cards. For example, fraudsters check their card’s balance way too often; normally, people would not do this. Additionally, a lot of fraud buyouts are typically made at night time and these transactions reflect a large amount of money made in a short time.

To identify fraudsters, the team built an anomaly detection model that utilized VAEGMM (Variational Auto-Encoding Gaussian Mixture Model). The other approaches, based on Isolation Forest, OneClassSVM, and Clustering (DBSCAN) unsupervised machine techniques, were tested during the model selection phase. The later approaches did not perform as well when compared to VAEGMM, which is why they were not chosen.

The system helped to identify all of the fraudster reward cards, as some of the fraudsters used different cards for different transaction types. As a result, the client received several reports:

The anomaly detection POC (proof of concept) detected fraud with high accuracy resulting in increased user satisfaction, enhanced security and improved workflows.

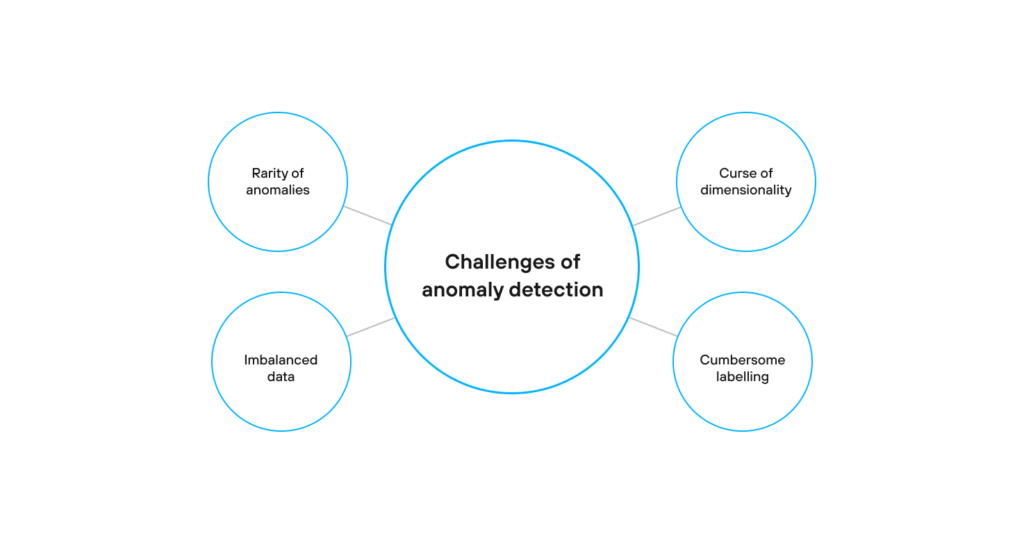

Detecting anomaly activities such as fraud, network intrusion, and other suspicious activities might be difficult as the abnormal patterns are rare and generally don’t appear frequently in the dataset. In addition, they are sparse and dissimilar in many ways, which prevents the normal data preparation techniques from being effective.

In addition to being rare, abnormal data points are also not represented equally. For example, after applying a classification technique to the dataset, a data scientist can obtain a model with results that are 85% accurate. However, once investigated further, it turns out that 85% of the data points belong to only one class. This is a perfect illustration of what is considered imbalanced data and how it can produce inaccurate results.

In big datasets that consist of multiple numbers of attributes and features, the volume of data that needs to be generalized is huge. This results in data sparsity, where data points are more scattered and isolated. Data sparsity creates high noise levels through multiple irrelevant variables that cover up the true anomalies. This challenge is called the “curse of dimensionality” or the multimodality in other sources, which creates an obstacle for anomaly detection techniques.

When analyzing data for anomalies, it’s difficult to obtain accurately labeled data that represents all the types of anomalous behavior. That’s why labeling is often conducted manually, which makes it expensive as it requires high domain knowledge. It’s also a tedious process as it’s quite time-consuming.

The Avenga AI & Data Science team is ready to help your organization detect anomalies and fraud-related activities. If you enlist our help, several Avenga data science experts will be assigned to your organization for a predetermined period (from 1 to 3 weeks), based upon purchased consultancy hours, to assist with the exploratory data analysis. Avenga will also assign a Senior Data Scientist as a resource to your company for the entire project duration. Furthermore, a Project Manager will support you and the team with planning and organization tasks.

The following are the key fraud detection project milestones:

Fraud prevention is never excessive. Harness the power of machine learning for anomaly detection with Avenga. By partnering with an experienced technology vendor like Avenga, you can be sure that fraud in your company can be prevented.

For many businesses, anomaly detection is a critical activity as it helps to identify outliers in their data and prevent any actions that may cause detrimental outcomes for the company and/or individuals. In particular, the late identification of frauds can lead to substantial money losses. An anomaly detection system helps companies be proactive in regards to fraud, rather than reacting to them weeks or months after the fraud has happened.

In this article, we’ve learned about the three types of anomaly detection algorithms: supervised, unsupervised and semi-supervised. And, that each of these ML algorithms has its own advantages and disadvantages.

We’ve also explored the anomaly detection project phases. The process of identifying outliers in the data starts with an exploratory data analysis, where a data scientist builds their initial hypotheses and assumptions about outlier patterns. Next, the data is cleansed and pre-processed to ensure that impossible data combinations and out-of-range values will not produce misleading results.

After that, the data is enriched with relevant additional information. This improves the quality and the accuracy of the machine learning results. Then, the actual machine learning algorithms are applied to the data where they actually “do their magic” and cluster the data as “normal” and “abnormal”. The model is trained on the actual data and afterwards it is tested on new data in order to see how well it can make predictions and identify anomalous patterns in unseen data. Next, the anomaly detection performance is assessed so that any gaps and/or weak points can be identified so the model can be improved.

We’ve also explored two real life examples on how anomaly detection was applied with our two clients. In the first fraud detection use case, we learned how the anomaly detection system has helped the Trōv insurance company detect fraudsters (suspicious clients) before insurance claims are paid.

The anomaly detection solution utilized unsupervised and supervised machine learning techniques to identify signals (features) that indicate fraud. As a result, Avenga’s Data Science team built a neural network that learns suspicious patterns from samples and is used later to detect anomalies.

Subsequently, Avenga’s client has shortened their claim resolution time by 30% and lowered the loss ratio (in the insurance industry the loss ratio represents a ratio of losses to gains). Thanks to the fraud detection system, Trōv has achieved a better operational efficiency and optimized their expenditures on customers’ claims.

In the second use case presented in this article, our task was to identify a fraudster’s loyalty cards and the locations the fraudster used to collect reward points for their purchases, and when the bonus funds were credited not to a customer, but to an employee.

To identify fraudsters, Avenga’s Data Science team analyzed the data of hundreds of thousands of users and came up with six possible types of fraud. All the users were clustered into fraudsters and non-fraudsters. Next, the Data Science team created a system that helped to detect fraudster reward cards and the locations where they were used. The model helped our client to identify fraudulent activities with very high accuracy.

In the very last section of this article we discussed the challenges of the anomaly detection process. In particular, when the anomalous activities are rare and don’t appear frequently in the data. As they aren’t represented equally in the dataset, it creates high noise levels that can cover up real anomalies. That’s why the machine learning algorithms have to be applied carefully and accurately to ensure they capture the true anomalies.

Our AI & data science team will help you apply the latest machine learning algorithms for anomaly detection in order to deliver impactful results. With timely fraud detection, your organization can move over existing barriers and save time as well as money, and start creating new opportunities.

Ready to innovate your business?

We are! Let’s kick-off our journey to success!